Checking out the Benefits and Dangers Linked With a Hard Money Finance

Browsing the intricate globe of real estate financing, capitalists usually come across the alternative of a Hard Money Lending. The crucial lies in recognizing these facets, to make a notified decision on whether a Hard Money Financing fits one's financial approach and risk tolerance.

Recognizing the Essentials of a Hard Money Funding

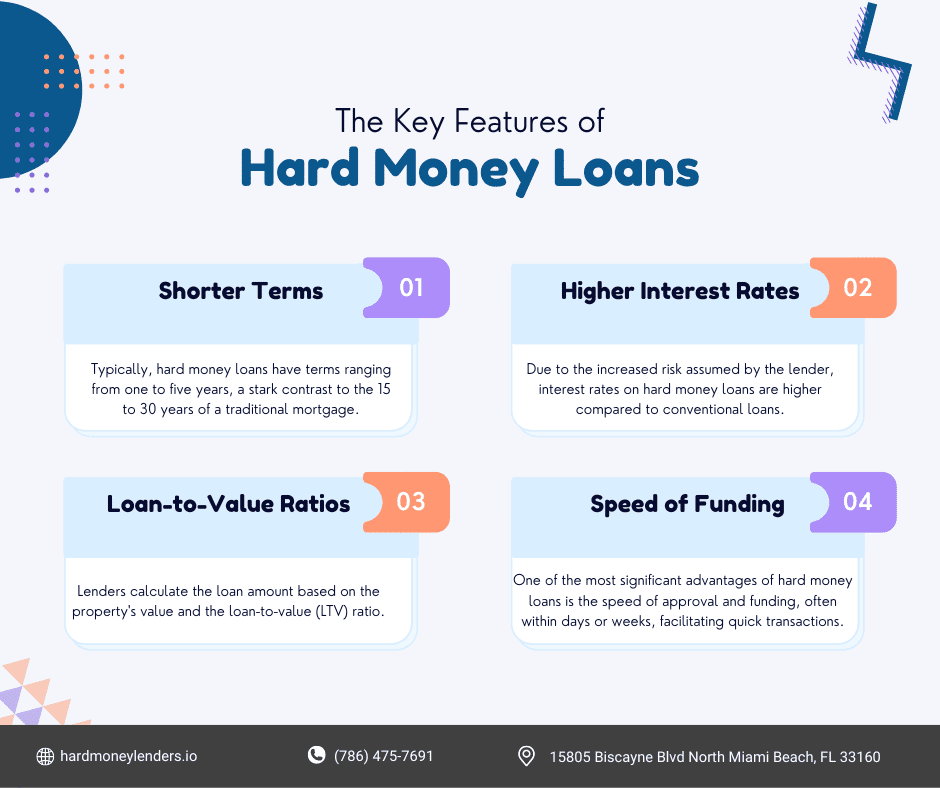

What precisely is a Hard Money Finance? Unlike standard bank fundings, difficult Money loans are based primarily on the value of the property being bought, instead than the borrower's credit score. These fundings are commonly made use of for financial investment functions, such as home flipping or advancement tasks, instead than individual, household usage.

Key Advantages of Opting for Hard Money Loans

Potential Risks and Downsides of Tough Money Fundings

In spite of the eye-catching advantages, there are some significant dangers and disadvantages associated with hard Money lendings. These finances usually come with high interest rates, occasionally double that of typical finances. This can cause financial strain otherwise handled effectively. Tough Money lendings typically have shorter repayment durations, usually around 12 months, which can be testing for borrowers to satisfy. Furthermore, these car loans are often safeguarded by the debtor's residential property. They run the risk of shedding their home to foreclosure if the consumer is incapable to repay the Funding. Difficult Money lending institutions are less regulated than typical loan providers, which may reveal debtors to unethical borrowing methods. Hence, while tough Money lendings can give quick financing, they likewise carry substantial risks. hard money lenders in atlanta georgia.

Case Scenarios: When to Think About a Hard Money Loan

Comparing Tough Money Financings With Other Financing Options

Just how do hard Money finances compare to other financing choices? When contrasted with typical financings, tough Money fundings supply a quicker authorization and funding process because of less regulations and demands. Nevertheless, they usually feature higher rate of interest go to this website and fees. In comparison, small business loan offer lower rate of interest however have strict eligibility requirements and a slower authorization time. Personal finances, on the various other hand, deal versatility in terms however might lack the structure and protection of tough Money finances. Last but not least, crowdfunding and you could look here peer-to-peer loaning systems use an unique alternative, with competitive rates and convenience of access, however may not appropriate for bigger financing needs. The choice of funding depends on the customer's specific demands and situations.

Final thought

In conclusion, hard Money finances use a practical remedy genuine estate capitalists requiring swift and versatile funding, especially those with credit report challenges. Nonetheless, the high passion prices and much shorter repayment timeframes demand mindful consideration of prospective threats, such as repossession. It's essential that customers completely review their economic technique and danger resistance prior to going with this kind of Lending, and compare it with various other funding alternatives.

Unlike typical bank fundings, tough Money finances are based mostly on the value of the property being browse around this site purchased, instead than the debtor's credit history rating. These finances frequently come with high passion rates, occasionally double that of conventional financings. In circumstances where a customer desires to stay clear of a prolonged Loan process, the a lot more uncomplicated difficult Money Financing application can use an extra convenient choice.

When contrasted with conventional lendings, tough Money fundings provide a quicker approval and financing procedure due to less demands and regulations - hard money lenders in atlanta georgia. Private lendings, on the various other hand, offer flexibility in terms however may do not have the structure and protection of hard Money lendings

Comments on “Top-Tier hard money lenders in Atlanta Georgia You Can Rely On”